Our Approach

- Our Approach

Transaction Engineering: Our Patented Four Step Approach

Our Transaction Engineering 4 Step Process is designed to ensure that both the structure of the financing and financing products are designed to meet your Contractor Financing Need:

Diagnosis

Based on the results of our diagnosis, we then develop a tailored financing strategy, structure, facility size, and funding products required. In addition, we also identify and develop a game-plan for addressing any issues that could impact funding approval, ie existing UCC filings, etc

Funding Strategy

We begin with a preliminary underwriting interview to understand your funding needs, objectives, timing , and any constraints . We also review financial statements bank records contracts and other details to assess your business condition .

Lender Selection

Drawing on our national network of asset based lenders commercial finance houses and banks we select the optimal funding partners . Our knowledge of lenders’ approval criteria documentation requirements rates and terms allows us to match you with the right provider .

Closing and Funding

We work alongside you and the lender from application through closing. Our role includes preparing the funding package negotiating rates and terms resolving UCC filings subordination or tax issues arranging vendor trade credit agreements and facilitating legal documents . We stay engaged until funding is completed and beyond.

- TESTIMONIAL

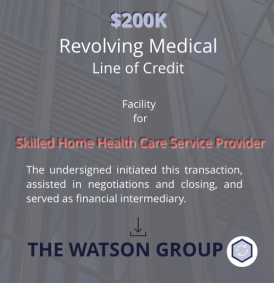

Our Clients’ Success Stories Speak For Themselves